Very Easy Experience

“Cathie, thank you so much for making this my Home Equity Loan a painless and very easy process!”

Branch Hours

Ready for your next big project?

Access the funds you need with a Citadel Home Equity Loan. Take advantage of a low, fixed-rate loan to get help paying for large purchases, major expenses, home improvement projects, or to consolidate debt. You can borrow up to 95% of your primary home’s appraised value or 80% of your vacation home’s appraised value, minus outstanding mortgages. Apply now!

➜ Determine how much you can borrow

➜ Calculate your loan payments

➜ Review the loan requirements

➜ Discuss current home equity rates

*Offers are subject to credit approval. REG = Regular Rate. APR = Annual Percentage Rate. Read Full Disclosures.

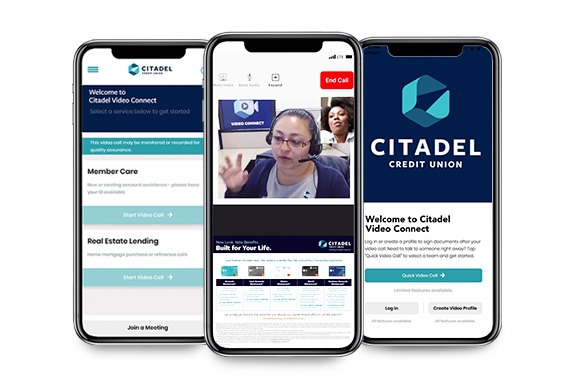

Citadel's Video Specialists are just a few clicks away with Video Connect. Skip the trip to the branch office and video chat safely and securely from your preferred location. Learn More.

On your laptop, desktop, or mobile device, our Video Specialists can help you complete almost any banking-related task:

✔ Open a new account

✔ Add a product to a current account

✔ Apply for a loan

✔ Talk to a business banking expert

Still have questions? Visit our help center.

Citadel is an Equal Housing Lender.

Fixed Home Equity Loans

Rate expressed as Annual Percentage Rate (APR), and is subject to change without notice. Offer can be withdrawn at any time. APR shown is for second lien position loans up to 80% Loan-To-Value (LTV) on single-family owner-occupied properties in PA, NJ, MD, and DE. Loans above $500,000 will require borrower to purchase title insurance. Various APRs and terms are available up to 95% LTV with excellent credit. Lender fees will apply. Home equity third party fees ($415-$1,000). Offer is subject to credit approval, income verification and appraisal. Existing mortgage loans must be current and have no late payments in the last 12 consecutive months. Property insurance is required. If the collateral is determined to be in an area that has special flood areas, flood insurance will be required as well. Property cannot be a co-op or mobile home. Other restrictions may apply. *Rate as of .