Welcome to Citadel

Auto Loan Center

Thank you for financing your auto loan with Citadel Credit Union! We’re excited to help get you on the road and pride ourselves on offering competitive auto loan rates for new and used vehicles. We know how important it is to be able to manage your loan quickly and easily, including viewing auto loan details and making payments. You can also find information about your Citadel Star Savings account and other Citadel resources.

Payment Options

Payment Options

Citadel offers multiple secure and convenient ways to make payments, either through your Citadel account or an account with another financial institution. Visit our Payments Page for full details on all payment options.

| Loan Payment Options | ||

| Citadel Online & Mobile Banking Payment | Online & Mobile Banking Details | Enroll Now! |

| Automatic Recurring or One-Time Payments | Pay from another Financial Institution | Set up Auto Pay with Citadel |

| Debit Card or eCheck Payment | Debit Card or eCheck Options | Pay Now! |

| In Person Payments | Find a Citadel Branch | |

| Pay by Mail |

Citadel Credit Union |

How To Make a Loan Payment

With Citadel's Online & Mobile Banking, you can submit one-time or recurring payments on your auto loan. You can also use the loan payoff calculator to determine when and how to best pay your balance. Here's how it works.

Online Loan Management

Online Loan Management

Citadel's Online & Mobile Banking is the easiest and most flexible way to manage your auto loan online. You can make payments, view loan history, due date, and payoff amount, and update your account information.

First Time Enrollees

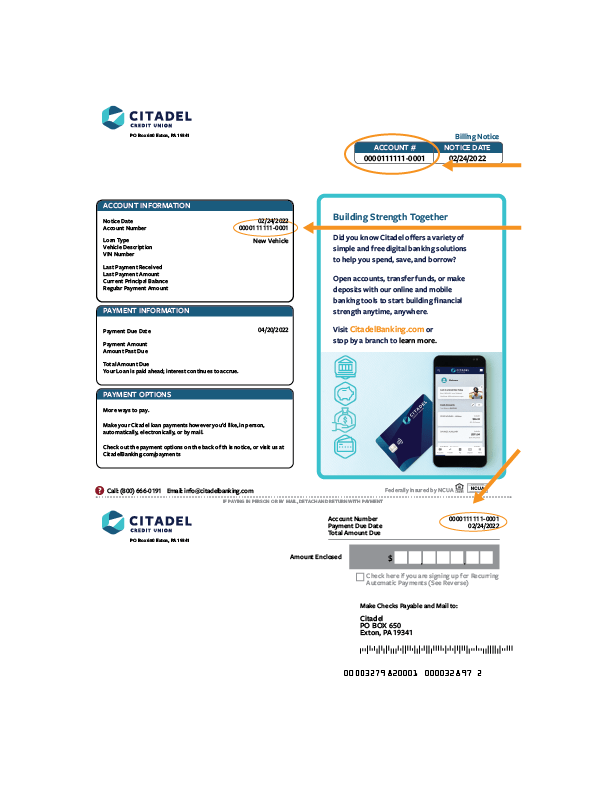

- Set up access in Online & Mobile banking using the six or seven digit account number found on your Billing Statement.

- Once enrolled, you can schedule your loan payment from any financial institution or pay directly from your existing Citadel account.

Existing Account Holders:

- Log into your Citadel account and select Loan Payment from the Payments main menu.

- Recurring Payments can also be scheduled using the Transfer Funds option from the Transactions menu.

Adding and Transferring from an External Account:

Using Online & Mobile Banking, you can add your external accounts and schedule your payment to recur every month or as a one-time payment. You can instantly link your external account and start making payments immediately. Here are the steps to add your external account:

- After logging in Select Accounts > Manage External Accounts.

- You will have the option to link an external account via Instant Verification or with Micro Deposits if your financial institution is not listed. Simply select the option you prefer and follow the prompts to link your account(s).

- Once your external account setup is complete, you can schedule a one-time or recurring payments.

*IMPORTANT: Your six or seven digit account number is required to enroll in Online & Mobile Banking. You can find your account number on your Billing Statement. Please note: You will need the six or seven numbers between the leading zeros and the last four zeros listed in the account number displayed on the billing statement. Example: 000-1111111-0000. See example below.

Skip-a-Payment Program

For those times in life when you need a little extra cash, skipping a loan payment might be a good solution. With Citadel’s Skip-a-Pay, for a $35 fee you can skip your upcoming auto loan payment. It’s easy to skip payments yourself through Online Banking or the Citadel Mobile App. Find out if you have an eligible loan today, here's how:

- Log in to Online or Mobile Banking

- Select "Skip-a-Pay" from the main menu, or select "More" from the mobile menu

- Accept the terms and conditions, then select the loan you would like to skip and which account to pay from. That's it!

Updating Insurance

Additional Tools & Resources

Updating your Auto Insurance & Collateral Protection Insurance (CPI)

Be sure to update your Auto Insurance carrier with Citadel Credit Union as the new lienholder for your vehicle. Then provide that proof of coverage to Citadel so we can add to your loan records. If a policy does not meet the minimum insurance requirements of an auto loan, Collateral Protection Insurance (CPI) could be added to your loan. The CPI premium charge is added to the loan principal, which increases the loan payments. If proper proof of insurance coverage has not been provided, Citadel will send you a notice regarding the addition of CPI to your loan at least 45 days before we charge you for coverage. It will include:

- The date of the notice

- You and your lender's respective names and mailing addresses

- A request for insurance information for your vehicle

- A thorough description of why your previous coverage was inadequate, as well as information about your CPI plan.

In most cases, you’ll need to provide proof of other insurance coverage. If you already have sufficient coverage and the issue was due to a lack of documentation, you can typically submit proof of your insurance coverage and the problem will be resolved. Proof may be submitted as follows:

- Call Citadel's insurance tracking center at 866-366-1049. Weekdays: 8 a.m. - 10 p.m. EST Saturdays: 9 a.m.- 6 p.m. EST. IVR (interactive voice response) available 24/7.

- Fax directly at 877-647-1562. Please note: faxes are processed in an average of 4 hours if received on weekdays and are reviewed within 2 business days

- Visit MyLoanInsurance.com/CitadelBanking to submit insurance information

The Credit Union Difference

The Credit Union Difference

At Citadel Credit Union, we don’t have stockholders—we have members. Since credit unions are not-for-profit and operated to promote the well-being of their members, the money the credit union makes is returned to members in the form of reduced fees, higher savings rates, and lower loan rates.

By financing your auto loan with Citadel, you are now a member of the credit union, giving you automatic access to even more great products and services. Citadel not only provides top of the market auto loan rates and low fees, but offers personalized service as well. Our experienced Member Care team can assist you with calculating auto loan payments, reviewing your loan details and more.

Your Automatic $5 Savings Share

Every credit union member is required to have a savings share, an account that represents your “Share” in the credit union and makes you a part owner of Citadel. When you opened your auto loan, we gave you a complimentary $5.00 savings share so you can enjoy all the benefits of membership including the opportunity to vote in our board elections and take advantage of all the other accounts, loans, services, and money-saving discounts. As long as you remain a member, we’ll hold the $5 in your account, and you can continue to save as you wish. You can continue to use this share, but there is no requirement to take any action. If you decide to close your account, you’ll take that money with you when you go. If you have any additional questions about this, please contact us.

Why Our Members Matter

Learn more about how a credit union is different from a traditional bank, why our members truly matter, and how they receive the best pricing and service in the area.

We're Much More than Auto Loans

At Citadel, we offer much more than competitive auto loan rates. There are plenty of additional ways Citadel can help you save money and enjoy more financial freedom in your life.

We offer a full suite of personal banking products, including:

- Checking Accounts

- Low-Rate Credit Cards

- High-Rate Savings Accounts

- Personal Loans

- Education Loans

- Mortgages

- IRAs

- Home Equity Loans

More Information

✔ 24 Branch Locations - We have several branch locations so banking with us is always convenient.

✔ Citadel Express Banking - It's like an ATM, only better. With 24/7 access to all of your Citadel accounts, you can make a deposit, get cash, make a loan payment, and more.

✔ Contactless Payments - Experience a faster and more secure way to pay with your contactless Citadel Mastercard.

Learn more about Citadel's auto loan rates today!

Get StartedWelcome to Citadel: Your Auto Loan Start Guide

We’re glad you’re here. This short video will walk you through what to expect as you get started with your auto loan and show you how to make the most of the tools and support available to you. In this video, you’ll learn: • A quick introduction to who we are and how we serve our members • What happens next in your loan process • How to set up digital banking and recurring payments • Easy ways to get in touch whenever you need help Our goal is to make everything simple, clear, and stress-free. We’re excited to support you on this journey—welcome to Citadel.

Why Choose Citadel?

Citadel is a not-for-profit credit union that exists to serve the people, businesses, and neighborhoods of Greater Philadelphia, so they can prosper.

Here’s why you should join us:

![]() Better rates & low (or no!) fees

Better rates & low (or no!) fees

![]() No tricks or hidden selling tactics

No tricks or hidden selling tactics

![]() Personalized banking experiences, online & in-person

Personalized banking experiences, online & in-person

![]() Open to anyone who lives or spends time in Southeast PA

Open to anyone who lives or spends time in Southeast PA

![]() All you need to do is open a $5 savings account to join

All you need to do is open a $5 savings account to join

Frequently Asked Questions

There are several ways to make a payment to your Citadel Loan. Visit our Payments page for full details.

| Loan Payment Options | ||

| Automatic Recurring or One-Time Payments | Pay from another Financial Intuition | Set up Auto Pay with Citadel |

| Debit Card or eCheck Payment | Debit Card or eCheck Options | Pay Now! |

| Online & Mobile Banking | Online & Mobile Banking | Enroll Now! |

| In Person Payments | Find a Citadel Branch | |

| Pay by Mail |

Mail Payment Address: |

Still have questions? Visit our help center.