Loan Payment Frequently Asked Questions

Frequently Asked Questions

Get all the answers you need to quickly and easily make a payment to your Citadel loans.

Loan Payment Frequently Asked Questions

Citadel is just around the corner, so banking with us is always convenient! We have several locations. Stop by any Citadel branch to make your payment. We would love to see you!

Our Branch Locator tool is built to help you find a location near you quickly and easily. Or view a list of all our locations.

Citadel’s Online & Mobile Banking is the easiest and most flexible way to pay your auto loan online. Once enrolled, you can schedule your loan payment from any financial institution or pay directly from your existing Citadel account.

Existing account holders:

- As an existing Citadel account holder, making your loan payment is simple and easy! Just select the loan you would like to pay and click 'make a payment'

- Choose your 'From' account in the drop down menu

- Then select your loan account in the 'To' field. Use the drop down to choose the payment type you would like to make. Available Payment Types vary by loan. You may edit the payment amount, however, the amount may not be less than the minimum payment due

- Click or tap 'Submit'

- You will receive a confirmation screen once the payment has been submitted

Adding and Transferring from an External Account:

Using Online & Mobile Banking, you can add your external accounts and schedule your payment to recur every month or as a one-time payment. Once your External Account is added, it will appear in your account list. Here are the steps to add your external account:

- After logging in, select "Transfers & Payments" > "External Accounts" on desktop or "Transfer/Pay" > “External Accounts” from the menu in mobile. You may need to complete multifactor authentication and/or get a secure access code to add an external account

- You will have the option to link an external account via Instant Verification or with Micro Deposits if you financial institution is not listed. Simply select the option you prefer and follow the prompts to link you account(s)

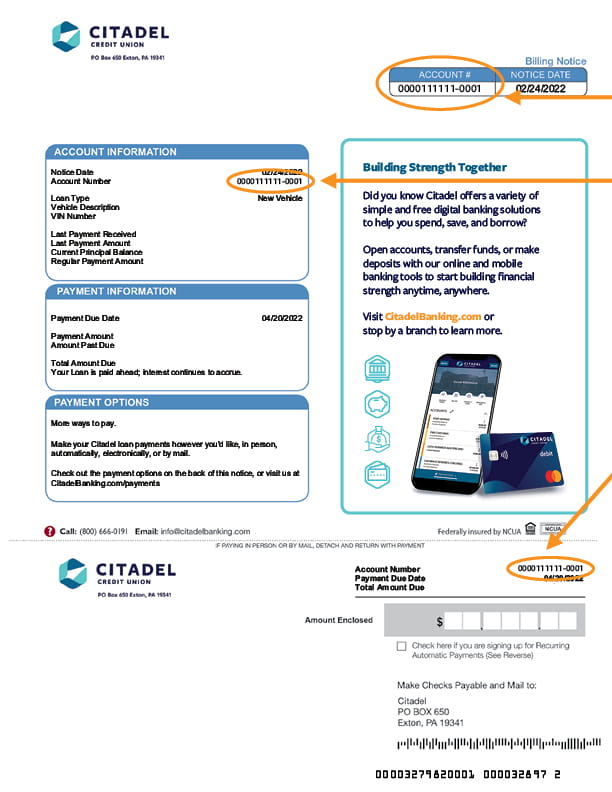

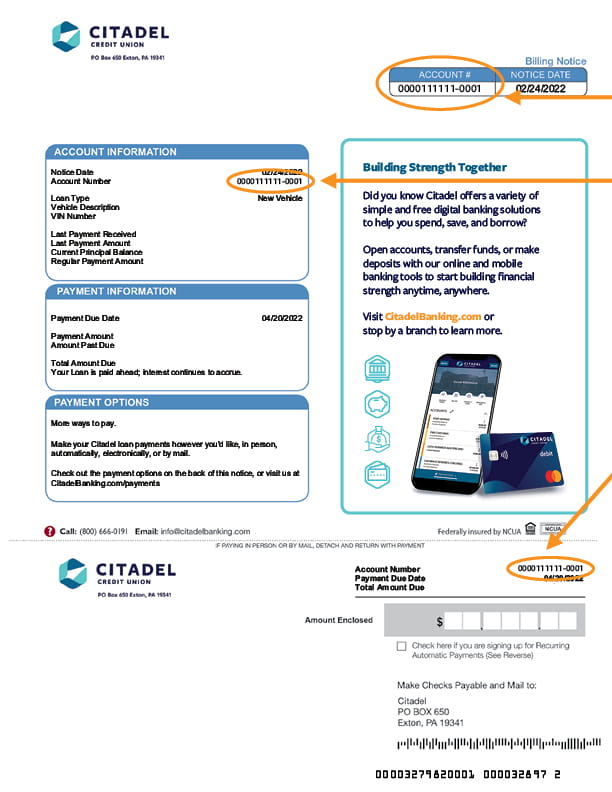

IMPORTANT: Your six or seven digit account number is required to enroll in Online & Mobile Banking. You can find your account number on your Billing Statement. Please note: You will need the six or seven numbers between the leading zeros and the last four zeros listed in the account number displayed on the billing statement. Example: 000-1111111-0000. See example below (click to enlarge).

Need to pay bills online? Citadel offers an online payment option for your loan using another institution's debit card or eCheck. This is a great option if you need to make a payment right away. Payments are accepted and posted 7 days a week, 365 days a year and will post at approximately 9:00 p.m. every day. Make a payment now!

Please use the account number (without the leading zeros or suffix) as it appears on your Billing Statement to complete your payment: Example: 123456(7)

Please note: A fee applies to each of these payment methods.

| Express Pay Option | How to Pay | Fee Applied |

| Online | Pay Now | $2.75 |

| Self-Pay by Phone | Call (877) 909-5685 | $2.95 |

| Pay by Phone with a Representative | Call (800) 666-0191 | $5.50 |

Make your secure payment now!

Adding and Transferring from an External Account:

Using Online and Mobile Banking, you can add your external accounts and schedule your payment to recur every month or as a one-time payment. We've partnered with Plaid, to allow you to instantly link your external account and start making payments immediately. Here are the steps to add your external account:

- After logging in Select "Make a Transfer" > "External Accounts" on Desktop and “Transfer”>”External Accounts” from the menu in Mobile

- You will have the option to link an external account via Instant Verification or Micro Deposits if your financial institution is not listed. Simply select the option you prefer and follow the prompts to link your account(s).

- Once your external account setup is complete, you can schedule a one-time or recurring payments.

✔ Instant account authentication (no micro deposits)

✔ Schedule automatic recurring payments each month with ACH

We offer a couple of ways to set up recurring loan payments with Citadel.

Online Banking:

Using Online Banking, you can add your external accounts and schedule your payment to recur every month or as a one time payment. Here are the steps to add your external account:

- After logging in, select "Transfers & Payments" > "External Accounts" on desktop or "Transfer/Pay" > “External Accounts” from the menu in mobile. You may need to complete multifactor authentication and/or get a secure access code to add an external account

- Select the financial institution you would like to add and follow the prompts or you can add the account manually with the routing number and account number

Or visit in person at any Citadel branch

Adding and Transferring from an External Account:

Using Online and Mobile Banking, you can add your external accounts and schedule your payment to recur every month or as a one-time payment. You can instantly verify your external account and start making payments immediately. Here are the steps to add your external account:

- After logging in, select "Transfers & Payments" > "External Accounts" on desktop or "Transfer/Pay" > “External Accounts” from the menu in mobile. You may need to complete multifactor authentication and/or get a secure access code to add an external account

- You will have the option to link an external account via Instant Verification or with Micro Deposits if your financial institution is not listed. Simply select the option you prefer and follow the prompts to link your account(s).

- Once your external account setup is complete, you can schedule a one-time or recurring payments.

IMPORTANT: Your six-digit account number is required to enroll in Online and Mobile Banking. You can find your account number on your Billing Statement. Please note: You will need the six or seven numbers between the leading zeros and the last four zeros listed in the account number displayed on the billing statement.. Example: 000-1111111-0000. See example below (click to enlarge).

To qualify for Skip-a-Pay, your loan must meet the following requirements:

- All loan and deposit accounts must be in good standing

- No accounts may have a negative balance

- All loans must be current at the time of the request (grace period does not apply)

- You may not have any charge offs, bankruptcy filings, or repossession against Citadel

- If a loan has been in any type of loan assistance or deferral program within the last 12 months, it may not be eligible for the Skip-a-Pay program.

Please note all deferrals are subject to approval and other restrictions may apply. Citadel reserves the right to discontinue or modify the Skip-a-Pay program at any time if it is deemed to be in the best interest of the credit union.

To skip a payment in Online & Mobile Banking:

- Log in to your account online or in the mobile app.

- Select the three dots (…) from the menu at the top on desktop or Menu (bottom right), More, then Skip-a-Pay on mobile.

- Accept the Terms and Conditions before continuing.

- Select the loan you would like to skip and the account from which you would like to draw the fee.

- Click review and submit.

If you have multiple loans with different ownership, you will need to utilize the switch account feature to access other loans.

Skipping a payment results in an extension of your auto loan by one month whenever you skip. All other terms and conditions as stated in your original loan document remain the same.

If you skip a payment for your home equity line of credit, there will be no extension of your draw period or your repayment period. Skipping a payment moves the current payment to the following month, doubling that payment.

The fee to skip a payment is $35 per eligible loan being skipped.

No. Interest/finance charges will continue to accrue at the rate provided in your original loan agreement. Deferring a payment will result in higher total interest/finance charges than if payments were made as originally scheduled.

Still have questions? Contact Us.