Above & Beyond Service

“I stopped in to replace my debit card. The Citadel associate introduced me to the new Cashback Rewards Checking Account that would save me a monthly fee and earn cash back rewards.”

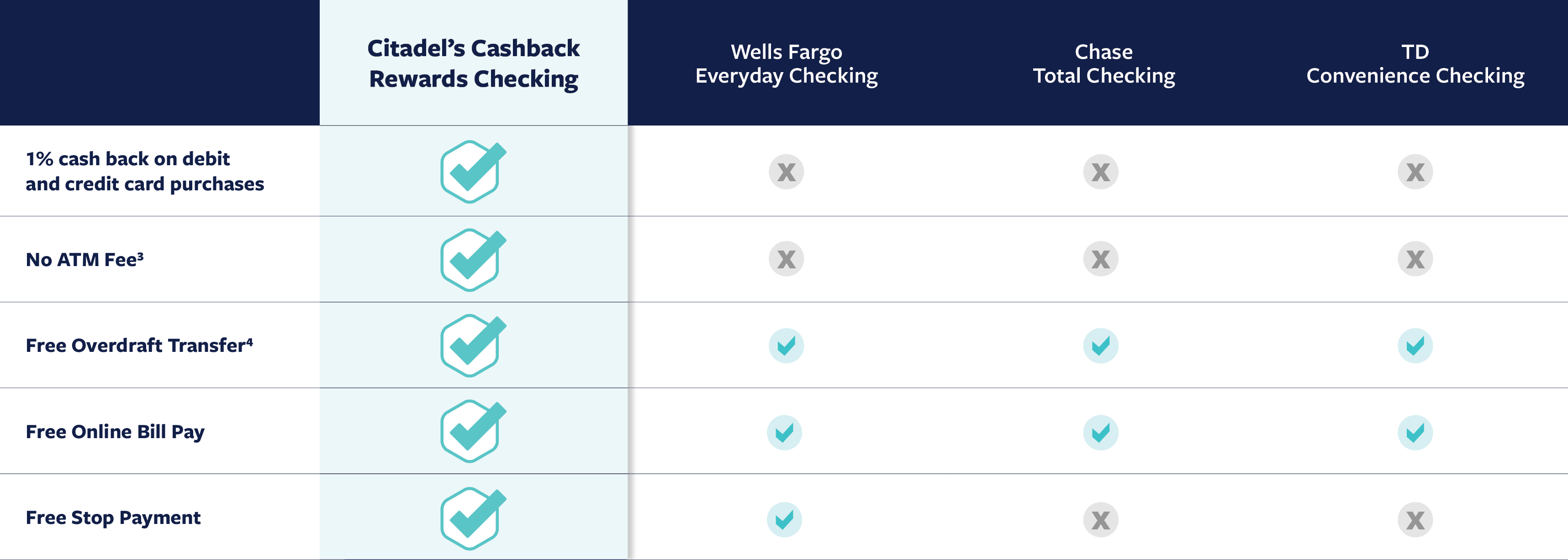

The Checking Account that Maximizes Your Cash Back

Our Cashback Rewards Checking Account gives you 1% cash back on all qualifying debit and credit card purchases so you can maximize your earnings. Earn up to $120* Cashback Rewards on everyday purchases every year from Citadel. In addition, use your contactless credit or debit card to make everyday purchases. Simply Tap & Go™ wherever you see the contactless symbol ![]() at checkout.

at checkout.

It's fast and free! Open your new Cashback Rewards Checking account today.

Download our form and have your Direct Deposit sent to your new Citadel Cashback Rewards Checking Account

Get 1% cash back on up to $1,000 in qualifying debit or credit card purchases a month.

Monthly service fee, if account requirements are not met; waived for 60 days following account opening2 (excludes ages under 21)

Paper account statement fee (waived for 60 days following account opening; after 60 days waived for members under age 21 and 70+)

Monthly Inactivity Fee5

Courtesy Pay overdraft protection fee4

Non-sufficient funds (NSF) fee

Citadel is committed to helping you protect your hard-earned money. All deposits are federally insured up to $250,000 or more per customer.

Available Cashback Rewards can be redeemed through Online Banking or our Mobile App. You can also call or visit CitadelBanking.com to redeem your Cashback Rewards.

When you choose to redeem, the full balance of available cash back must be redeemed and will be instantly deposited into the Cashback Rewards Checking Account. Any Cashback Rewards not redeemed by the account anniversary date will automatically be deposited into your Citadel Cashback Rewards Checking Account during the following statement period.

To redeem online, follow these two easy steps:

You can convert your current Checking Account to a Cashback Rewards Checking Account through Online and Mobile Banking, by calling Citadel, or visiting us in a branch. Converting your account is easy in Online and Mobile Banking:

Your account number and card number will stay the same.

Members can withdrawal funds of up to $600 per day for ATM withdrawals that includes any surcharge fees. For example, if you wish to takeout $600 and the ATM charges a $3 fee the most you withdrawal is $597.

To avoid any fees, visit any Citadel branch or use our locator tool to help you find your nearest Citadel ATM.

Still have questions? View a complete list of FAQs.

Information accurate as of and is subject to change without notice. All rates expressed as Annual Percentage Yield (APY). Minimum daily balance to earn APY is $5,000. Fees may reduce earnings.

*Balance Requirements:

To earn Cashback Rewards and avoid a $10 monthly service fee, one of the following criteria must be met:

A qualifying direct deposit is defined as a recurring direct deposit of payroll, pension, Social Security, Government benefits, or other regular monthly income, electronically deposited into the account. Internal or external transfers from one account to another, mobile deposits, and deposits made at a banking location, ATM, or through Online and Mobile Banking do not qualify as a direct deposit.

Earn Up to $120 in Cashback Rewards Annually:

When Cashback Rewards transaction requirements are met, earn 1% cash back on Citadel debit and/or credit card purchases that post to your account each statement cycle. Maximum Cashback Rewards: $10 per month. Cashback Rewards will be calculated at month end on net purchases (purchases minus any credit or returns). ATM withdrawals, credit card cash advances, and credit card balance transfers are not considered purchases and will not earn Cashback Rewards. A Citadel debit or credit card must be linked to your Cashback Rewards Checking account to earn Cashback Rewards on purchases. Each Citadel debit or credit card may only be linked to one Cashback Rewards Checking account. When Cashback Rewards Checking balance requirements are not met, Cashback Rewards will not be earned.

Full balance of available Cashback Rewards may be redeemed at any time during the year through Online and Mobile Banking, Citadel’s Mobile App, or by contacting Citadel. Partial redemptions are not allowed. Cashback Rewards not redeemed by the account anniversary date will automatically be deposited into your checking account during the following statement period. Earned Cashback Rewards can only be deposited to your Cashback Rewards Checking account. Account must be active and in good standing at time of cash back redemption.

Additional Account Information:

The Cashback Rewards Checking Account is not available for business accounts or public funds. Limit 5 Cashback Rewards Checking accounts per member. Cashback Rewards Program may be modified or withdrawn at any time.

**Monthly Inactivity:

A $5 monthly inactivity fee will apply if there is no activity on any Citadel account for one year – this fee is waived if the combined balance of all deposit accounts is $500 or more. Inactivity is defined as a 365-day period during which there were no customer-initiated transactions on any Citadel account.

***Important Information about Overdrafts and Overdraft Fees:

An overdraft occurs when the available balance in your account is not sufficient to cover a transaction. Citadel offers several options for you to avoid the potential embarrassment and extra expenses caused by a bounced check or insufficient funds. These include:

As a Citadel member, if you have a checking account and qualify, you will automatically be enrolled in Courtesy Pay when you open your account. If you wish to use one of the other options, which may be free or less expensive than Courtesy Pay, you can sign up at any time. To learn more, please ask a Citadel Representative. For a complete list of fees associated with overdrafts, please refer to Citadel’s fee schedule.

This notice refers to our Courtesy Pay program:

Citadel offers Courtesy Pay for its members and may pay overdrafts for the following types of transactions:

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction. If we do not pay an overdraft, your transaction will be declined and not paid.

If you want to use Courtesy Pay to pay overdrafts for one time, everyday debit card transactions (e.g. Starbucks®, Home Depot®, grocery stores, gas stations, etc.), you must opt in and give us your permission. You can opt in by:

You cannot use Courtesy Pay to pay for overdrafts on ATM withdrawals.

When you use Courtesy Pay, we will charge you a fee of $33 each time we pay an overdraft. There is no limit on the amount of total fees we can charge you for overdrafting your account. Any fees charged will count against your Courtesy Pay limit. For information on Citadel's check clearing policies, please contact us at (800)-666-0191 . You can opt out of Courtesy Pay at any time. Please visit any branch, or contact us at the toll free number above.

Federally Insured by NCUA.

By proceeding, please note you will be leaving Citadel’s website. This linked site is not operated or monitored by Citadel Credit Union and our privacy and security policies do not apply. Citadel is not responsible for and does not endorse, guarantee or monitor content, availability, viewpoints, accuracy, products, or services that are offered or expressed on other websites.