Mortgage and Home Equity Toolkit

Mortgage Rates, Tools, and Calculators

Find all the tools and resources you need to make the most of mortgages and home equity loans here. You can compare mortgage rates or use our calculators to estimate monthly payments and refinance savings. Explore our articles and videos to learn more about buying a home, or using the equity you’ve already built up to make improvements and repairs that will pay off in the long run.

Compare Citadel Mortgage Rates

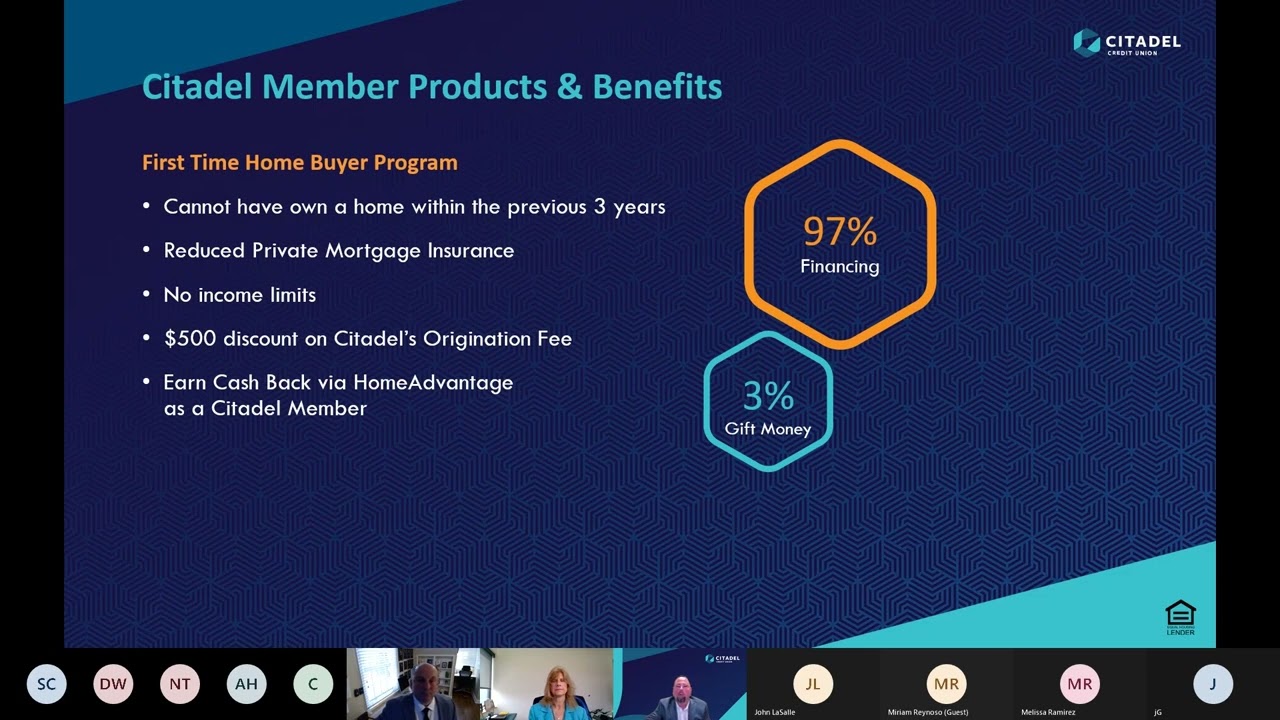

Buying your first home? Our First-Time Home Buyer program was made for you!

Open The Door

Calculate Costs & Build Knowledge

The more you know, the better you can manage your mortgage, home equity, and overall financial wellness. Estimate payments, taxes, and savings here with our interactive calculators.

Plus, you can watch videos, read articles, and browse FAQs below.

<nordpass-listeners></nordpass-listeners>Confused? Overwhelmed? Not sure where to start?

We’re here to helpWatch & Learn

Homebuying & Mortgages

Read Our Blog

Whether you’re just starting to think about buying your first place or ready to downsize for retirement (or anywhere in between!), “home” is a fundamental part. Explore our library of articles and discover a wealth of information on buying and selling a home, using your home equity, managing your mortgage, and more.

Frequently Asked Questions

Have a different question? Get answers here.

Frequently Asked Questions

An Escrow Account may be optional, for the borrower’s convenience, or required by the lender based on certain loan conditions. Usually the decision to setup an Escrow Account is made when you apply for your loan. Escrow Accounts can also be added or removed during the life of the loan. If you would like to add or change an Escrow Account please contact our Mortgage Servicing department for more information. The fee to remove escrow is .25% of the current principal balance.

Typically the insurance company will send us a copy of the homeowner's insurance bill. If you change insurance providers please let us know immediately so we can update our records and avoid missed invoices.

Yes, with as little as a 3% down payment to qualified borrowers.

PMI premiums and term vary based on the terms of the mortgage. Although PMI is scheduled to end on a specific date it may be possible to have it removed early.

At least 3% down plus money for your closing costs. We can help you calculate the amount you need.

Fixed Rate mortgages are the best product if you plan on living in the home for the next fifteen to thirty years and want the same principal and interest payment.

ARMS are the best product to keep payments lower for the fixed term. You can prepay at any time without penalty and shorten the term of your mortgage. If you won't be living in this home more than 10 years you may want to consider an ARM.

Points can be purchased to lower the interest rate over the life of a mortgage. Points are based on the percentage of the amount borrowed. With a $100,000 mortgage, for example, 1 point is equal to 1% of $100,000, or $1,000.

Private Mortgage Insurance, also called PMI, is a type of mortgage insurance you might be required to pay for if you have a conventional mortgage loan. PMI is usually required when you have a conventional loan and make a down payment of less than 20 percent of the home’s purchase price. This short term insurance protects the lender against loss if a homeowner defaults on their mortgage. Using PMI allows home buyers to purchase their house with a lower down payment.

The following tax documents will be mailed as applicable to the current address on file by January 31, and will be available in Online & Mobile Banking by mid-February each year.

- 1098: Mortgage Interest, Private Mortgage Insurance, Property Taxes and Late Fees

- 1099-C: Cancellation of Debt

- 1099-INT: Interest on Deposits (+ value of account opening gift if applicable)

- 1099-MISC: Non-Corporate Vendor Expense Report

- 1099-NEC: Non-Employee Compensation

- 1099-Q: Education IRA Distributions

- 1099-R: IRA Distributions

For members over the age of 73, the FMV/RMD: IRA Fair Market Value (All IRA’s) / RMD form will also be mailed by January 31. This form is for informational purposes only.

The following forms will be mailed as applicable:

- 5498-ESA Education IRA Contributions: By May 1

- 5498 IRA Contributions: By May 31

To prevent statement delays, please make sure the contact information on file for your account, including your mailing address, is updated and correct. For your security, this information cannot be updated via phone.

Access tax forms and documents in Online & Mobile Banking

Your tax forms and documents will be available by mid-February each year when you log in to your Online & Mobile Banking accounts.

💻 On desktop

1. Select Documents and Statements from the menu

2. On the Tax Forms & Notices tab, select the year to view and/or download it

📱 On mobile

1. Select Menu (bottom right)

2. Select Documents and Statements, then eStatements and Documents

3. On the Tax Forms & Notices tab, select the year to view and/or download it

If you are not signed up for Online & Mobile Banking, you can enroll here.

Most tax collectors do not provide information electronically. If your tax collector doesn’t provide the information we will contact you and request that you send the bills in to Mortgage Servicing.

Your Homeowners Insurance agent should send your annual statement to us automatically. If you change insurance providers please let us know immediately so we can update our records and avoid missed invoices.

Still have questions? Visit our help center.

*Preapproval is based on non-verified information and is not a commitment to lend. Final loan approval and amount are based upon all income and asset information.

Quick Close Guarantee

Citadel’s Quick Close Guarantee offers assurance to customers purchasing a home with a Citadel mortgage that the loan will close on or before the contract closing date agreed to by an authorized Citadel Mortgage Loan Officer, or the customer will receive $5,000 cash back, subject to the following criteria.

Eligibility: To be eligible for Citadel’s Quick Close Guarantee, the customer must (1) maintain an account with Citadel Credit Union (“Citadel”) that is in good-standing or individuals who become a new Citadel customer; (2) complete a Citadel mortgage application online, by telephone, or in-person; (3) provide all supporting documentation (including any income or asset verification materials) required by Citadel to render a lending decision in a timely manner, with each document being thoroughly completed, as well as any fully executed disclosures; (4) provide Citadel with a fully-executed purchase agreement which includes all pages, addendums, and required signatures by all parties; (5) request a loan for an amount less than the maximum of 97% LTV; (6) request a loan for an amount greater than the minimum of $50,000 and lower than the maximum of $2,000,000; and (7) meet all of Citadel’s current underwriting standards.

Closing Date: The contract closing date must be at least 21 calendar days after our receipt and acceptance of a completed mortgage application, all supporting documents, and a fully-executed purchase agreement. This offer is only available for new, residential first-lien loan applications submitted directly to Citadel. Only home purchases that are under Agreement of Sale and have a completed loan application received by Citadel on or after April 1, 2023 are eligible to participate in Citadel’s Quick Close Guarantee. Submissions received after this date, or the program end-date are not eligible to participate in the Program. For any property that receives an initial appraisal that is subject to repairs/completion, a final inspection will be required. Citadel guarantees closing within 7 business days of receipt of a satisfactory final inspection. The $5,000 cash back will be paid in the form of a deposit to a Citadel account, post-closing. Citadel’s Quick Close Guarantee will not apply in any of the following cases: (1) changes to the original closing date as documented in the original purchase agreement provided to Citadel; (2) changes in the loan amount, loan product, or other terms requested by the borrower(s) within 10 days of closing; (3) closing date extensions due to a delay in completion of any new home construction, improvements, or repairs being made to the subject property; (4) failure by any party, including the builder, seller, or buyer to meet the sales agreement terms and requirements, including any seller-related delays; (5) Easy Refinance, VA and FHA loans; (6) delays caused by 3rd parties other than Citadel required service providers; (7) delays due to any force majeure events such as severe weather or disaster events. Citadel’s Quick Close Guarantee offer expires October 31, 2023. Citadel reserves the right to amend, withdraw, or terminate the Citadel Quick Close Guarantee at any time and without prior notice. Any awards transferred at or outside closing in excess of the value of the underwriting fees may be considered miscellaneous income received from Citadel and we may be required to send you, and file with the IRS, a Form 1099-MISC (Miscellaneous Income) or Form 1042-S (Foreign Person’s U.S. Source Income Subject to Withholding) for the year in which you participate and are awarded the benefits of this program. You are responsible for any tax liability related to participating in the program. Please consult your tax advisor if you have any questions about your personal tax situation. All home lending products are subject to credit and property approval. Rates and program Terms & Conditions are subject to change without notice. Citadel’s Quick Close Guarantee is only available to Citadel customers residing in PA, NJ, DE and MD. Other restrictions and limitations may apply.

Conventional Purchase

Rate expressed as Annual Percentage Rate (APR), and is subject to change without notice. Offer can be withdrawn at any time. APR shown is for first-lien position loans up to 97% Loan-To-Value (LTV) on single-family owner-occupied properties in PA, NJ, MD, and DE. Various APRs and terms are available. Loans will require borrower to purchase title insurance and appraisal. Lender fees will apply. LTVs above 80% must escrow taxes. LTVs below 80% may escrow taxes at request of homeowner. Offer is subject to credit approval, income verification and appraisal. Existing mortgage loans must be current and have no late payments in the last 12 consecutive months. Property insurance is required. If the collateral is determined to be in an area that has special flood areas, flood insurance will be required as well. Property cannot be a co-op or mobile home. Other restrictions may apply. *Rate as of .

Traditional Mortgage

Fixed Rate Mortgage Terms

Rate expressed as Annual Percentage Rate (APR), and is subject to change without notice. Offer can be withdrawn at any time. APR shown is for first-lien position loans up to 95% Loan-To-Value (LTV) on single-family owner-occupied properties in PA, NJ, MD, and DE. Various APRs and terms are available. Loans will require borrower to purchase title insurance and appraisal. Lender fees will apply. LTVs above 80% must escrow taxes. LTVs below 80% may escrow taxes at request of homeowner. Offer is subject to credit approval, income verification and appraisal. Existing mortgage loans must be current and have no late payments in the last 12 consecutive months. Property insurance is required. If the collateral is determined to be in an area that has special flood areas, flood insurance will be required as well. Properties currently listed for sale are not eligible. Property cannot be a co-op or mobile home. Other restrictions apply on cash-out mortgage loans. Rate as of .

Adjustable Rate Mortgage (ARM)

An Adjustable Rate Mortgage (ARM) means that your payment may change in the future. Citadel ARM mortgages have a fixed rate for a period of time, then rates can adjust semi-annually. The fixed rate period varies based on the ARM loan you select and is shown right in the name of the ARM loan. Citadel offers two ARM loans: a SOFR 7/6 ARM and SOFR 10/6 ARM. The ARM numbers, “7/6”, show how long the initial fixed rate lasts and how often the rate can change afterward.

For Example:

• A 7/6 ARM has a fixed interest rate until the 84th month (7 years) and can change every 6 months after.

• A 10/6 ARM has a fixed interest rate until the 120th month (10 years) and can change every 6 months after.

What is a SOFR ARM?

SOFR is Secured Overnight Financing Rate, and is a referenced rate established to replace LIBOR (London Interbank Offered Rate). The Secured Overnight Financing Rate (SOFR) is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

How is my rate calculated?

The initial fixed interest rate is based on interest rate, loan amount, and total term of the loan when your loan is closed. This is the discounted rate and lasts for 7 or 10 years depending on the ARM loan selected.

The Adjustable Interest Rate is based on an interest rate index plus a margin. All of our Citadel ARM mortgage interest rates are based on the 30-Day Average SOFR rate, rounded to the nearest 0.125% (currently .08%). More information about this index is available at SOFR Averages and Index Data - FEDERAL RESERVE BANK of NEW YORK (newyorkfed.org). Our current margin is 2.750%.

How can my Interest Rate change?

Your interest rate can adjust when the initial fixed interest rate period ends, and every 6 months thereafter. Your interest rate will never increase or decrease more than 5 percentage points during the first adjustment, and 1% with each adjustment after the first, over the life of the loan.